Cash Predict - Best Personal Finance App for iPhone, iPad & Mac

Micromanaging expenses is ancient thinking.

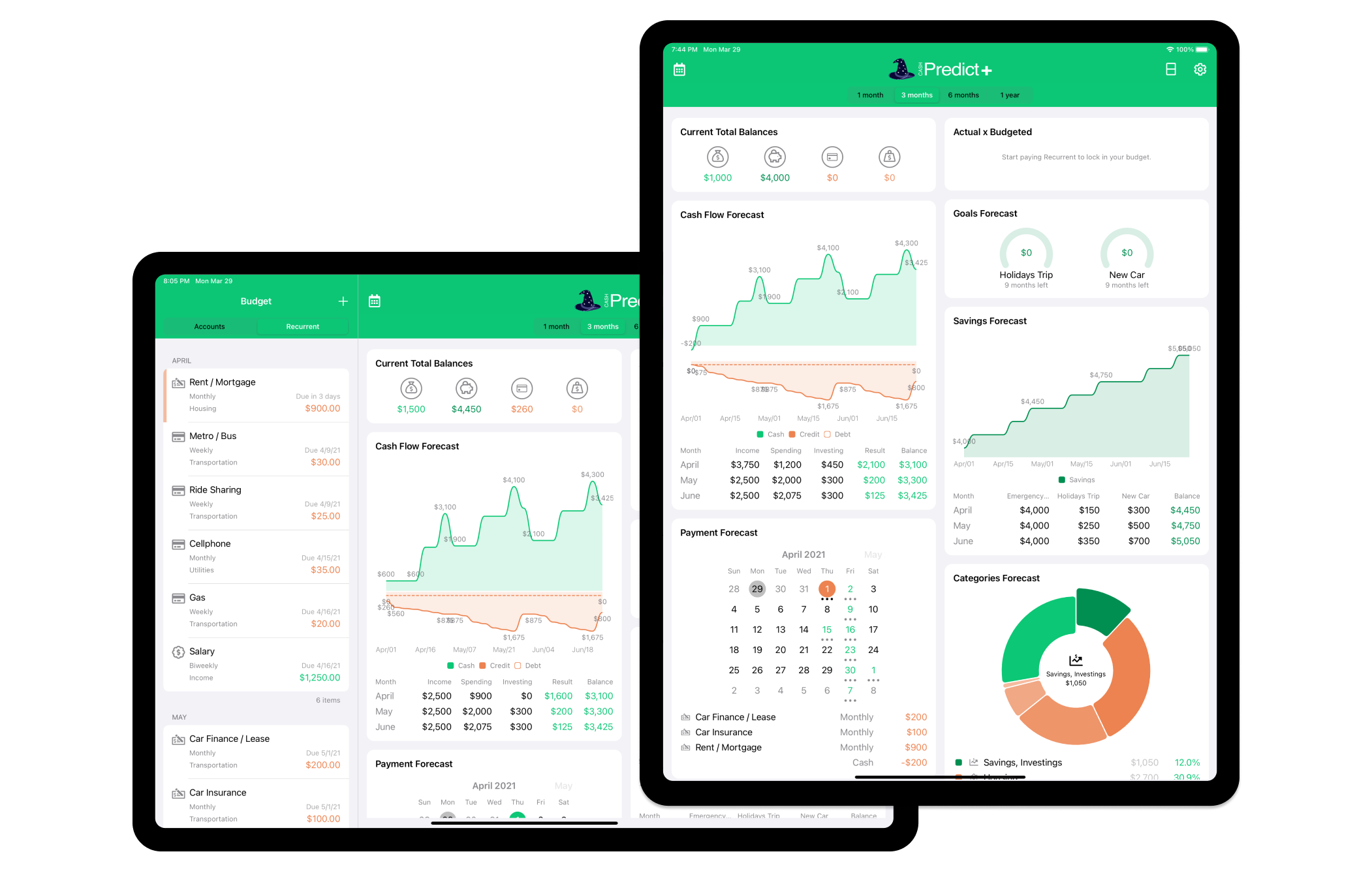

Cash Predict is all about your present and future.

Made with 🤍 for

iPhone | iPad | Mac | Watch

Micromanaging expenses is ancient thinking.

What's Cash Predict Personal Finance App About?

Instead of torturing yourself with the past, why not acting on your future? It doesn't really matter how or where you spent your money in the past month, Cash Predict personal finance app gives you actionable financial insights you can use to improve your budget management and achieve your financial goals.

-

Financial Goals Timeline

When you'll be able to pay off your debts, if any? How long until you have that down-payment money or can afford your dream trip?

-

Budget Scenario Planning

Can you afford an unexpected expense? Are you confident there's money to cover bills and investments?

-

Financial Progress Tracking

How much money you'll have saved by sticking to your budget? Is your net worth growing or shrinking? Is your budget balanced?

Advanced Features

Best Personal Finance App for iPhone, iPad, Mac and Apple Watch

The ultimate personal finance app that works seamlessly across all your Apple devices, synchronizes via iCloud, and maintains complete financial data privacy for secure budget management.

-

Multi-Device Personal Finance Management

Made with love for iPhone, iPad, Mac and Watch.

-

Synchronizes via iCloud

You can have your data seemlessly synchronized via iCloud across all your Apple devices.

-

Keeps your data private

No need to create a user account: we don't know who you are. Keep your data to yourself: we don't transmit your data anywhere.

Micromanaging expenses is ancient thinking.

How to Start Using Cash Predict Budget Tracker?

Cash Predict budget tracker focuses on your financial future, not past expenses. The present is represented by your current account balances, while the future shows expected income and scheduled bill payments for comprehensive financial planning.

-

1. Add Your Bank Accounts

Your accounts balances represent your present and you can track checking, savings, credit, and debt.

-

2. Schedule Recurring Bills & Income

The income you expect to receive and the bills you've committed to pay represent your future.

-

3. Receive Bill Reminder Notifications

When recurrent become due, Cash Predict will notify you, helping you stay on top of your bills.

-

4. Track Payment Status

Cash Predict automatically updates your accounts balances and schedules the next recurrent.

-

5. Maintain Account Balance Accuracy

Adjust your accounts balances to reflect ordinary expenses restaurants, gifts, etc: no need for micromanaging.

Advanced Features

Financial Forecasting & Future Planning

Stop dwelling on past financial mistakes. Take control of your personal finances today with Cash Predict's advanced budgeting tools and build a stronger financial future.

-

Stop crying over spilled milk

Cash Predict keeps you looking ahead, with eyes on your financial future.

-

Take action today

Using Cash Predict, you have the opportunity of taking action today and build yourself a better tomorrow.

-

Build yourself a better future

Pay off any debts faster, achieve short term goals, get into the habit of saving.

Micromanaging expenses is ancient thinking.

Advanced Personal Finance Management for Your Present and Future

Unlike most personal finance apps that focus on past expenses and promote buyer's remorse, Cash Predict budget tracker keeps you focused on your financial future with forward-looking budget planning and cash flow forecasting.

The most powerful feature? The ability to change your financial future. Using Cash Predict's advanced budgeting tools and financial planning features, you can take action today to build better financial habits and achieve your money management goals.

-

Privacy-First Finance App

We don't want you to enter or import all your past expenses, because we won't profile you nor sell your financial information.

-

Focus on Financial Goals

We don't offer charts or reports depicting your past, because they won't make you a better spender: developing good habits will.

-

Forward-Looking Financial Planning

Feeling bad about the money you already spent won't change a thing or bring any good. Getting into the habit of budgetting and saving will.

-

Secure Financial Data Management

Receiving offers for credit cards you don't need and / or loans you shouldn't take? Stop the leak and reinforce your privacy.

Advanced Features

Smart Bill Reminders & Advanced Cash Flow Forecasting

Advanced financial scheduling, smart bill reminders, and comprehensive cash flow forecasting for complete personal finance management.

-

Advanced Bill Scheduling System

Schedule income, expenses, and transfers. Configure frequency (weekly, biweekly - monthly, etc), and set the number of installments or make it steady.

-

Smart Payment Alert System

Configure up to two alerts for upcoming recurrent and the best time of the day to receive the notification.

-

Comprehensive Financial Forecasts

Beautiful, elegant and easy to understand charts and reports depicting all your financial future.

Frequently Asked Questions About Cash Predict Personal Finance App

Get answers to common questions about our budget tracking and financial planning app

Install now and try it out!